Yesterday GlobalFoundries acquired MIPS to bolster their IP offerings. SemiAccurate thinks this is a good deal for both sides, it fills fabs and gives GF something unique to offer customers.

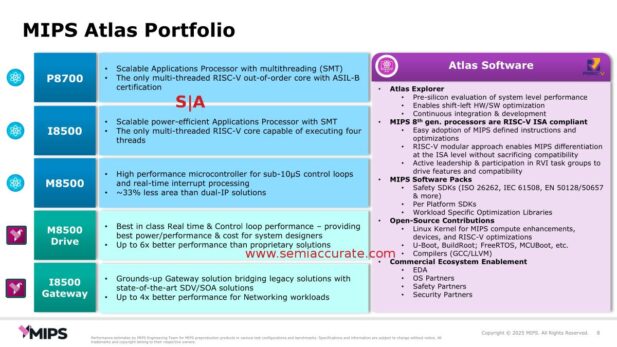

If you haven’t been paying attention, MIPS is now a RISC-V company with a variety of cores to offer customers. These aren’t the usual shoelace tip controllers that many people think of when they think of RISC-V, there are some pretty hefty chips in the lineup. Why you aren’t aware of them is mainly because they are aimed at spaces most people don’t follow, embedded and automotive being the big ones, big doing double duties in that sentence.

You need the right side to sell the left

If you look at the offerings above, you will see some fairly interesting terms like SMT, ASIL-x, and real-time. Nothing unique here but there are a lot of features that some others in the space lack. Better yet they are all RISC-V based so open source ISA, not locked-in proprietary stuff.

Possibly more important than hardware is the pink/purple box on the right, yes software. A great chip with no software is not very useful and MIPS knows this. Their Atlas software offerings starts from pre-silicon work and has offerings for safety, Linux, and even commercial partners. This is above the usual table stakes of a compiler and drivers that some offer and it means a lot, especially to the automotive community. Don’t underestimate what it takes to get and maintain any ASIL rating.

Another important factor are the people now at MIPS. Without going in to names that probably don’t want to be in the spotlight, there are quite a few big ones who now work at MIPS. When SemiAccurate met with the company at CES, the names that cropped in the conversation were known to us and had long histories of doing impressive things in the silicon space. Given the engineering pedigree at the company, we think things are looking up for future offerings.

So back to the point of the article, GlobalFoundries, why does GF want MIPS? MIPS has offerings that have real customers and exist in spaces that are compatible with GF’s process nodes. That is a really polite way of saying GF hasn’t had a new node for a while and is unlikely to be on the bleeding edge ever again. That said the automotive and embedded space doesn’t always need 2nm devices, a controller usually has finite needs and if that can be met with a 16nm device, great, it saves money.

When performance calls for much smaller geometries, the customer can make the device elsewhere and GF gets a cut. Win/win. That said there are real customers, MIPS says Mobileye and a “Tier 1 Cloud Provider”‘s smartNIC all use their IP so there is a market. And of course no modern presentation would be complete without mentioning the AI market as a target, especially embedded and automotive AI. Unlike most BS slides, MIPS might have a point here.

In the end, there is nothing but upside to this deal as far as we can see. MIPS gets a backer and more physical IP help and GF gets a portfolio of cores and IP it can offer to customers. If GF doesn’t have a process to make the target device on, no foundry is going to turn away a customer because some of the IP comes from GF. It is going to be interesting to see where MIPS goes from here, if anyone wants odds on what the specs for the next SGI Octane will be packing… 🙂 S|A