Precize is an alternative investment platform based in India that specializes in providing retail and institutional investors access to unlisted equity shares, commonly known as pre-IPO shares. These shares represent ownership in companies that are not currently traded on any stock exchange. Precize aims to democratize private investments, making them more accessible and transparent for everyday investors, who traditionally have found it challenging to participate in this space.

Overview and Mission

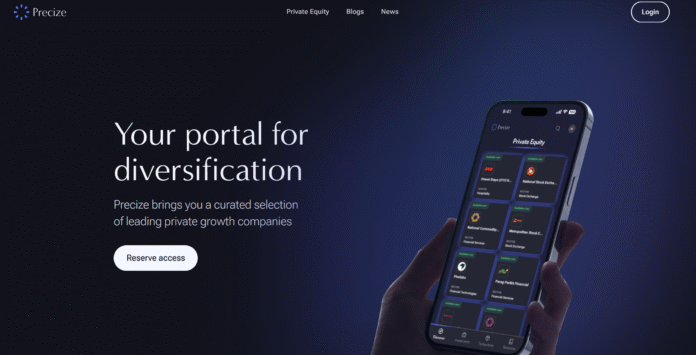

Precize envisions a future where private market assets are as easily accessible and navigable as public markets, breaking down barriers that have historically reserved these opportunities for a privileged few. This platform acts as a portal connecting investors to a curated selection of private companies, thereby elevating financial ventures and expanding investment horizons beyond conventional public markets.

Key Features of Precize

- Low Minimum Investment: Investors can start with as little as ₹10,000, lowering the entry barrier to private markets. This encourages greater participation from a wider pool of investors.

- Bank-Level Security: Precize enforces stringent security policies to protect sensitive personal information, ensuring investor data confidentiality and safety.

- Research-Driven Approach: The platform offers curated financial reports prepared by analysts. These include comprehensive analyses such as company balance sheets, cash flow statements, income statements, and evaluations of industry and peer performance, helping investors make informed decisions.

- Simple Investment Process: Investing is streamlined into three basic steps—select the company, place an order with funds, and receive shares in the investor’s depository account. This fast and hassle-free approach promotes ease of use.

- Ongoing Market Updates: Investors receive regular updates and news on pre-IPO shares and broader market trends, keeping them informed throughout their investment lifecycle.

What Are Unlisted Equity Shares?

Unlisted equity shares, or pre-IPO shares, are shares of companies not listed or traded on any recognized stock exchange. These shares are typically held by early investors, company promoters, or employees and represent ownership stakes in private companies. Investing in such shares provides a chance to participate in a company’s growth before it goes public, potentially yielding significant returns if the company successfully launches an IPO or grows in market value.

How to Buy Unlisted Shares in India

Investors in India can buy unlisted shares through various avenues:

- Intermediaries: Investors can purchase shares through intermediaries who facilitate the transfer of shares to the buyer’s depository account.

- Employee Stock Ownership Plans (ESOPs): Investors can buy shares sold by company employees at predetermined prices after lock-in periods.

- Direct Purchases from Promoters: Shares can also be bought directly from company promoters via private placements, facilitated by investment banks, brokers, or wealth managers trusted in the private equity space.

Precize provides a dedicated platform for these transactions, guiding investors through the process securely and transparently.

Using Precize to Buy Unlisted Shares

The platform offers a simplified, three-step investment process:

- Select a Company: Investors research and choose the private company they wish to invest in using Precize’s research tools and reports.

- Place an Order: Investors fund their accounts and place an order specifying the number of shares they want to buy.

- Receive Shares: Upon successful order confirmation, the purchased shares are deposited into the investor’s depository account, ensuring ease of ownership management.

Services and Offerings

- Access to Private Markets: Both retail and institutional investors gain entry into the private equity realm, which was traditionally the domain of high-net-worth individuals and large financial institutions.

- Research Reports: Detailed financial analyses cover various aspects of company performance and market conditions.

- Unlisted Shares Price List: The platform offers price histories for unlisted companies, enabling investors to track past price performances.

- Hassle-Free Experience: The investment experience is designed to be user-friendly, reducing complexity and barriers typically associated with private market investing.

Selling Pre-IPO Shares

Investors can sell their pre-IPO shares before or after the IPO launch:

- Before IPO: Shares can be sold within the unlisted market through Precize’s selling specialists who assist in finding buyers and facilitating transactions.

- After IPO: Once a company goes public, investors can sell shares on the listed market, but only after complying with lock-in periods mandated by SEBI (Securities and Exchange Board of India).

The standard lock-in period is six months from the listing date, during which shares cannot be sold on public exchanges.

Read More:Microsoft Rewards is a loyalty program

Taxation on Pre-IPO Shares

- Long-term capital gains (LTCG) on the sale of pre-IPO shares held for more than 24 months enjoy a reduced tax rate of 12.5%, down from the earlier 20%.

- Short-term gains remain taxed at the applicable marginal income tax rate.

This taxation framework incentivizes longer holding periods for better tax efficiency.

Legal and Regulatory Disclaimer

Precize operates as a private investment platform but is not a stock exchange. It is not authorized by market regulators to solicit investments, and the securities traded are not listed on regulated exchanges. Investors are cautioned that private market investments involve risks, including potential loss of capital. Past performance is not indicative of future results. The platform provides information and investment opportunities but does not provide personalized investment or legal advice.

Contact and Location

Precize’s office is located at The Summit Business Park, Andheri East, Mumbai, Maharashtra. Customers and interested investors can reach out via their support email or phone number for assistance and further information.